GOVERNANCE

ARTICLES OF INCORPORATION

As described in the Corporate Governance Report on page 100 of this Annual Report, the Articles of Incorporation of Tecan include the following provisions on compensation:

- tasks and responsibilities of the Compensation Committee (Art. 17)

- compensation principles applicable to the Board of Directors and the Management Board (Art. 18 and 23)

- shareholders’ voting modalities on compensation motions at the Annual General Meeting, including the additional amount for members of the Management Board who were nominated after the shareholders’ approval of the maximum compensation amount (Art. 18)

- provisions around credits and loans to the Board of Directors and the Management Board (Art. 20)

- maximum permissible number of external mandates for members of the Board of Directors and the Management Board (Art. 21)

- provisions related to contractual agreements with members of the Management Board and the Board of Directors (Art. 22)

The full Articles of Incorporation are available on the corporate website

SHAREHOLDER REQUIREMENTS FOR BOARD OF DIRECTORS & MANAGEMENT BOARD MEMBERS

In 2024 the Board of Directors issued new Shareholder Guidelines for all Members of the Board of Directors. These minimum shareholding requirements came into effect on January 1, 2025. The guideline formally requires all Directors to hold, as a minimum, the number of shares in Tecan Group AG, which corresponds to the sum of the three most recently received share grants from Tecan Group AG. Based on the current split in Board of Directors compensation between cash and equity, this will result in holding on average at least 100% of annual compensation in Tecan shares. For new members of the Board of Directors and for current members of the Board of Directors who do not meet these requirements as of January 1, 2025, a maximum period of three years in office applies for building up the required shareholding.

A shareholding requirement for Management Board Members was already issued by the Board of Directors in 2023. The details of this Management Board shareholding requirement were outlined in the 2023 Compensation Report.

The objective of both policies is to encourage and ensure that the Members of the Management Board and the Board of Directors have a vested interest in the long-term success and value creation of the company by holding a relevant amount of its shares.

ROLE OF SHAREHOLDERS ON COMPENSATION

The compensation and approval mechanism at Tecan is set out in the Company’s Articles of Incorporation. They are based on the Swiss Code of Obligations (OR Art. 734), which came into effect as per January 1, 2023.

Each year, the Board of Directors proposes to the shareholders at the Annual General Meeting for their approval the maximum aggregate amount of compensation to the Board of Directors for the period until the next Annual General Meeting and to the Management Board for the following financial year. In addition, the Board of Directors presents the Compensation Report for a retrospective, advisory shareholder vote. The voting mechanism on the compensation motions is shown in illustration [1]. For further details on the compensation votes at the upcoming 2025 Annual General Meeting, please refer to the section “Outlook and Motions on Compensation at the Annual General Meeting”.

ILLUSTRATION [1]: COMPENSATION AND APPROVAL MECHANISM

COMPENSATION COMMITTEE

The Compensation Committee supports the Board of Directors and acts as preparatory body in all relevant compensation matters related to the Board of Directors and the Management Board. In accordance with the Articles of Incorporation and the Organizational Regulations of Tecan, the Compensation Committee is composed of at least two members of the Board of Directors who are elected individually by the Annual General Meeting for a period of one year. At the 2024 Annual General Meeting, the shareholders re-elected Dr. Christa Kreuzburg (Chair), Dr. Oliver Fetzer, Dr. Daniel Marshak and Myra Eskes as members of the Compensation Committee.

The Compensation Committee meets as often as business requires. In the year under review, the Compensation Committee held four meetings in total which all members attended, with an additional circular resolution. The CEO, CFO and Chief People Officer (CPO) may be invited to attend the meetings in an advisory capacity. Invited members of the Management Board do not take part in discussions on agenda items concerning their own performance or compensation. The Chair of the Compensation Committee reports to the Board of Directors regularly on the activities of the Committee. Minutes are kept of the meetings and are available to all members of the Board of Directors.

The Compensation Committee acts in a preparatory capacity and proposes motions to the Board of Directors for approval. The Board of Directors approves the compensation policies for the entire Group as well as the general conditions of employment for members of the Management Board. The Compensation Committee took the decision in 2021 due to high volatility in salary changes and due to Tecan’s growth strategy to benchmark every year the compensation of the Management Board. The compensation of the Board of Directors is more stable and will therefore be benchmarked from 2021 onwards only every three years. Both benchmarking exercises are executed with the help of independent external consultants. The Compensation Committee proposes and submits compensation amounts to the Board of Directors for approval. The Board of Directors reviews and approves the performance achievement of the members of the Management Board and the actual variable cash compensation to be paid out. The approval and authority levels of the different bodies on compensation matters are detailed in illustration [2] below.

ILLUSTRATION [2]: DECISION AUTORITIES IN COMPENSATION MATTERS

| CEO | Compensation | Board of | Annual General Meeting |

Group compensation policy and principles |

| Proposes | Approves |

|

Maximum aggregate amount of compensation of members of the Board of Directors |

| Proposes | Reviews | Approves |

Individual compensation of members of the Board of Directors |

| Proposes | Approves |

|

Maximum aggregate amount of compensation of the Management Board |

| Proposes | Reviews | Approves |

Performance target setting and assessment |

| Proposes | Approves |

|

Performance target setting and assessment of other members of the Management Board | Proposes | Approves | Reviews |

|

CEO compensation |

| Proposes | Approves |

|

Individual compensation of other members of the Management Board | Proposes | Reviews | Approves |

|

Compensation Report | Proposes | Reviews | Approves | Advisory vote |

BENCHMARKING SUPPORTED BY EXTERNAL CONSULTANTS

Tecan periodically reviews the total compensation for the members of the Management Board and Board of Directors, comparing data from executive compensation surveys and published benchmarks from companies of similar size in terms of market capitalization, revenue, number of employees, geographic reach, etc., and/or which are operating in related industries.

In 2024 an independent external consultant conducted the annual benchmarking analysis of the compensation of the Management Board. Tecan also procures market data for non-executive positions from the same source.

A demanding labor market, combined with an increased volatility in compensation in the target industry as well as Tecan’s growth trajectory, brought the Compensation Committee to the conclusion that from 2021 onwards, benchmarking analysis should be conducted annually. As in the previous year, taking into account Tecan’s global footprint, the evaluation of the compensation levels and structure was compared to a transnational peer group: The peer group1 consists of listed companies only within life sciences and diagnostics, comprising similar companies found within Tecan’s operating markets in Europe and the US. It is focused and homogenous and allows for stability in the peer group in the coming years. The peer group is unchanged compared to the previous year. At the time of the analysis, Tecan positioned between the 25th percentile and the median of the peer group on market capitalization and employee count and at the mid-point on revenue. This positioning allows Tecan to continuously grow within the peer group as is currently anticipated. The EU/US peer group represented a 67%/33% split. Companies in the peer group operate in the same industry and target similar candidates and therefore compete with Tecan in the recruitment market. As a general outcome and compared to the peer group, the cash compensation paid to individual members of the Management Board was confirmed to be slightly below market practice. If the long-term incentive targets are significantly exceeded, (and only then), the total compensation may increase to levels above the market median. Consistent with earlier benchmarking exercises conducted in the past, the analysis showed that the compensation system at Tecan is more weighted towards the long-term incentive, while short-term compensation is positioned below market levels.

In accordance with the previously laid out three-year cycle, a separate benchmarking analysis by the same external consultant as in 2021 was conducted in 2024 to analyze the compensation of the Board of Directors. The previous peer group was reviewed and reduced from 18 to 13 companies due to delisting of existing peers and elimination of companies with a considerably higher or lower market capitalization or sales. To reflect the broad sourcing background of Board of Directors members, the peer group consists of 13 companies2, which are listed on the Swiss stock exchange SIX. The peer group includes companies from health care and life science, production and manufacturing, and technology. In comparison to the peer group, Tecan broadly sits at or slightly below the median in terms of market capitalization, sales and headcount. The benchmarking indicated that the compensation structure of Tecan's Board of Directors is largely in line with market practices. However, the total compensation is positioned below the market median for most roles. As a result, a potential increase in the board retainer and committee fees could be considered. Given the challenging market environment in 2024, the Compensation Committee advised against proposing a compensation increase at the 2025 Annual General Meeting. This topic will be reconsidered in 2025.

COMPENSATION PRINCIPLES

Tecan applies a set of uniform compensation policies, which are systematic, transparent and focused on the long-term perspective.

In line with good corporate governance, the compensation for the Board of Directors is fixed and does not contain any performance-based elements. This strengthens the Board’s independence in exercising its supervisory duties towards executive management. The fixed compensation is delivered in cash and in shares to strengthen the alignment with shareholders’ interests.

The compensation for the members of the Management Board is based on the following factors: financial performance of the Company, achievement of strategic goals including corporate sustainability goals, position within the Management Board and labor market situation. The ultimate goal of the compensation system is to attract and retain highly qualified and motivated employees, to ensure their long-term loyalty to the Company, incentivize performance and to align their interests with those of Tecan’s shareholders. The fixed and variable cash compensation programs are designed to cover the basic requirements, while the long-term incentive plan aligns total compensation with the long-term financial success of the Group and the value creation for shareholders of the Company.

A more defined claw back clause came into effect on January 1, 2024. This clause formalizes Tecan’s right in case of fraud, willful misconduct or a restatement of financial results to reclaim any part of the short-term or long-term incentive payment linked to misstated financial indicators, during a period of three years preceding the occurrence of a claw back event.

- Management Board Peer Group European Companies: Lonza Group AG, Mettler-Toledo International Inc, Eurofins Scientific SE, Smith & Nephew PLC, Carl Zeiss Meditec AG, Qiagen NV, GN Store Nord A/S, Evotec SE, Elekta AB, LivaNova PLC, Siegfried Holding AG, Bachem Holding AG; US Companies: PerkinElmer Inc, Bio-Techne Corp, Bruker Corp, Sotera Health Co, Neogenomics Inc, Medpace Holdings Inc.

- Board of Directors peer group: Bachem ,Belimo, Bucher, Clariant, Daetwyler, Galenica, Logitech, SFS, Siegfried, SIG Combibloc, Temenos, VAT Group, Ypsomed

COMPENSATION SYSTEM OF THE BOARD OF DIRECTORS

There is no performance-based compensation for Board members and members of the Board of Directors are not insured in the Company pension plan. The fixed compensation consists of a fee for services paid in cash and in Restricted Share Units (RSUs), as well as additional committee fees paid in cash. The cash compensation is paid in two settlements in May and November, while the RSUs are allocated annually at the beginning of the term of office on the basis of the Tecan share’s average closing price on the SIX Swiss Exchange during the first four months of the relevant financial year. The RSUs fully vest and are converted into Tecan shares upon completion of the annual term, or pro rata in the event of an early exit.

The Compensation Committee does not see the necessity of proposing adjustments to the compensation levels at the upcoming Annual General Meeting. The compensation of the Board of Directors was approved by the Board of Directors, and at the 2024 Annual General Meeting, as described in table [1] below:

TABLE [1]:

| Until 2024 Annual General Meeting | Since 2024 Annual General Meeting | |||

In CHF per year (gross) | Chair of the Board | Vice-chair of the Board | Member of the Board | Chair of the Board | Member of the Board |

Fixed basic fee (cash) | 200,000 | 90,000 | 80,000 | 200,000 | 80,000 |

Fixed basic fee (shares) | 100,000 | 55,000 | 45,000 | 100,000 | 45,000 |

| Until 2024 Annual General Meeting | Since 2024 Annual General Meeting | ||

| Committee Chair | Committee Member | Committee Chair | Committee Member |

Audit Committee | 30'000 | 10,000 | 30,000 | 10,000 |

Compensation Committee | 30'000 | 10,000 | 30,000 | 10,000 |

Nomination and Governance Committee | 30'000 | 10'000 | 30,000 | 10,000 |

In addition, members of the Board of Directors receive committee fees for ad-hoc committee meeting participation. They receive reimbursement for business travel expenditures incurred, and a travel fee (for members located overseas only).

COMPENSATION SYSTEM OF THE MANAGEMENT BOARD

The compensation system for members of the Management Board (including the CEO) did not change compared to the previous year. It is defined in several regulations adopted by the Board of Directors and comprises:

- fixed base salary

- employee benefits, such as pension benefits, company car and expense allowance

- short-term variable cash compensation

- long-term equity incentive award, as a fixed monetary amount which is converted into shares and serves as initial grant for the Performance Share Matching Plan (PSMP)

ILLUSTRATION [3]: COMPENSATION OF MANAGEMENT BOARD

| Vehicle | Purpose | Plan period | Performance measured |

Fixed base salary | Monthly salary in cash | Attract and retain | Continuous |

|

Benefits | Monthly benefits | Attract and retain | Continuous |

|

Short-term variable cash compensation | Annual bonus in cash | Reward annual performance | 1 year | Sales growth |

Long-term equity incentive award – PSMP | Grant of initial shares | Reward long-term performance Align with shareholders’ interests | 3 year | Sales growth Adjusted EBITDA margin |

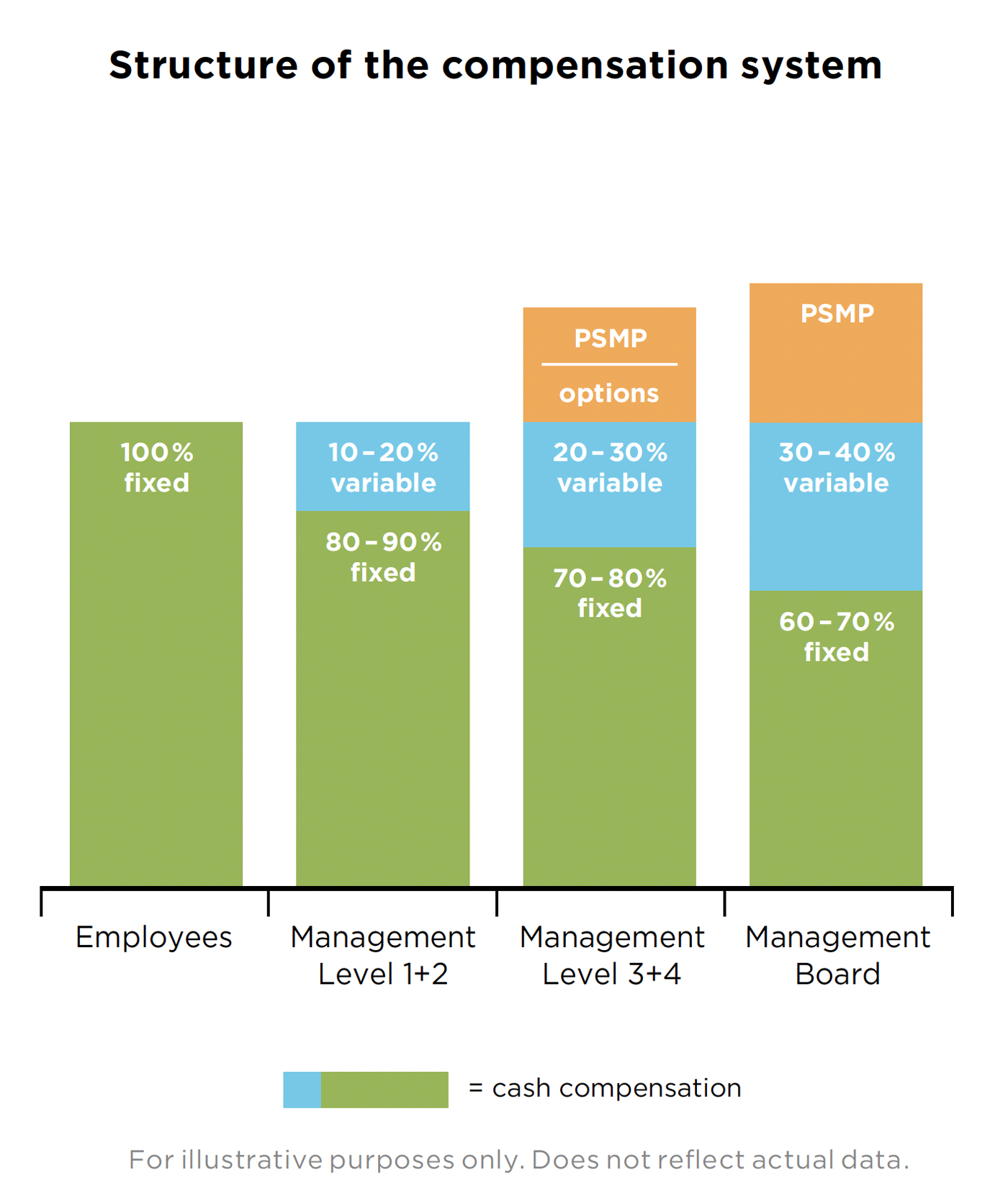

The compensation structure is based on a variable pay policy adopted by the Board of Directors, which provides for a total target cash compensation determined individually, consisting of a fixed base salary and a short-term variable cash compensation component. The total target cash compensation (assuming 100% target performance achievement under the short-term variable cash compensation) is weighted as follows:

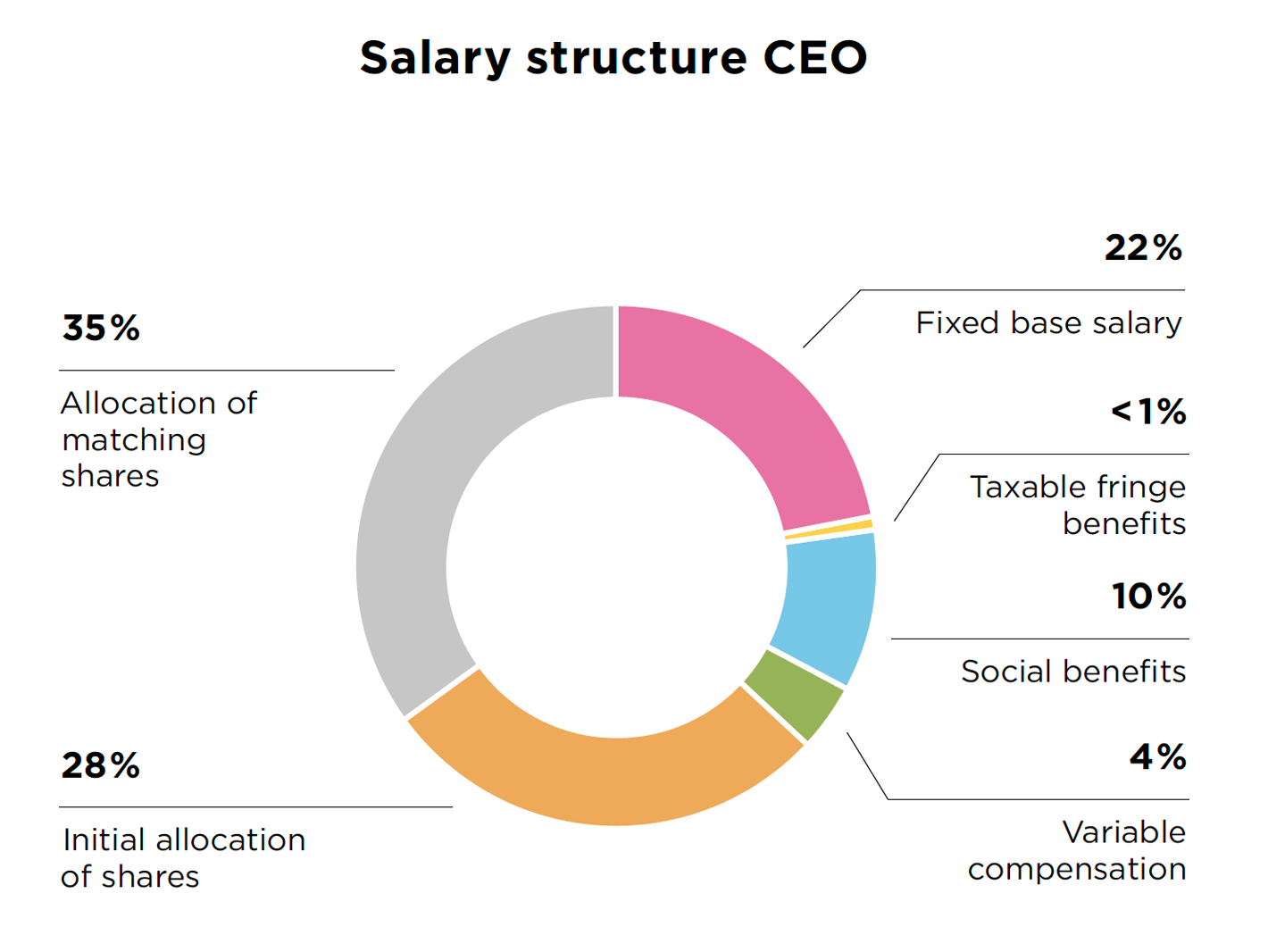

- CEO: 60% fixed base salary and 40% short-term variable cash compensation

- other members of the Management Board: 70% fixed base salary and 30% short-term variable cash compensation

In addition, members of the Management Board are eligible for an annual grant under the long-term equity incentive plan (PSMP). The short-term and long-term incentive plans are primarily based on the same underlying drivers of shareholder value: sales growth and improvements in operating profitability. In the life sciences and healthcare sector Tecan's ambition is to outgrow the market sustainably and with continued, simultaneous improvements in profitability. Therefore, Tecan finds these two parameters to be the best indicators of the creation of shareholder value in the Company's industry. A key difference between the short- and long-term incentives plans is the inclusion of a meaningful percentage share of specific timebound targets in the short-term incentive plan.

The compensation is subject to mandatory employer social security contributions (AHV/ALV). These contributions are paid by Tecan and are disclosed in the Compensation Report in compliance with Tecan’s reporting obligations.

FIXED BASE SALARY AND BENEFITS

The fixed base salary is a component of compensation paid in cash, typically monthly. It reflects the scope and key responsibilities of the role as well as the qualifications and skills required to perform the role, along with the employee’s skill set and experience.

Fixed base salaries of the Management Board are reviewed annually, taking into consideration the benchmark information, market movement, economic environment, and individual performance.

In addition, the members of the Management Board participate in the pension and insurance plan of Tecan which is also offered to all employees in Switzerland. Benefits consist mainly of contributions to the retirement and insurance plan which is designed to provide a reasonable level of protection for employees and their dependents with respect to the risk of retirement, disability, death, and long-term illness. Members of the Management Board are also provided with a company car and are eligible for an expense allowance in line with the expense regulation, which is approved by the Swiss tax authorities.

The monetary value of that and other elements of compensation is evaluated at fair value and is included in the compensation table in table [5].

SHORT-TERM VARIABLE CASH COMPENSATION

The short-term variable cash compensation is an annual variable incentive designed to reward the performance of the Group over a time horizon of one year.

The short-term variable cash compensation target (i.e., at 100% target achievement of the performance objectives) is expressed as a proportion of the total target cash compensation, as explained above, i.e., 40% of the total target cash compensation for the CEO and 30% for the other members of the Management Board.

In 2024 Tecan continued to offer all members of the Management Board a harmonized set of performance objectives. Hence, there are no individual performance goals in the short-term variable cash compensation, and it is solely based on Group financial performance objectives and corporate sustainability goals. The ambitious growth and profitability targets are set annually before the beginning of the financial year by the Board of Directors and assessed at the year end. For 2024, the same underlying financial performance indicators were applied as in previous years: sales growth in local currencies and the adjusted EBITDA margin of the Group. They are equally weighted and account for 80% of the short-term variable cash compensation. The corporate sustainability goals amount to 20% of the short-term variable cash compensation and are defined at Group level based on the strategic sustainability priorities of the Company. For 2024, the sustainability goals were related to environmental, social and governance aspects. For social aspects, the focus was on enhancing Tecan’s working culture and leadership competences. For environment and governance, an ESG data management platform and related global processes were implemented, which will enable closer tracking of Tecan’s progress against greenhouse gas emissions reduction goals. For each performance objective, the Board of Directors determines a threshold level of performance below which the payout percentage is 0%, a target level of performance corresponding to a 100% payout and a maximum level of performance, above which the payout is capped at 200%. Payout levels between the threshold, the target and the maximum are calculated by linear interpolation.

Looking ahead, the performance objectives for Management Board members responsible for the Life Sciences Business and Partnering Business divisions will be adjusted to include division-specific revenue targets in 2025. This shift from focusing solely on group targets to incorporating both group and divisional targets for revenue-generating divisions reflects a stronger emphasis on topline growth within each division, while still maintaining the group's profitability margin.

In addition, the Articles of Incorporation stipulate that the short-term variable cash compensation may not exceed 150% of the fixed salary for the CEO and 100% for the other members of the Management Board.

The respective weightings of the performance objectives are included in illustration [4].

ILLUSTRATION [4]: PERFORMANCE OBJECTIVES FOR THE SHORT-TERM VARIABLE CASH COMPENSATION

|

|

|

2024 objectives | Rationale/driver | Weighting |

Sales growth in local currencies (Group) | To drive the top-line growth of Tecan | 40% |

Adjusted EBITDA margin (Group) | To drive the bottom-line profitability of Tecan | 40% |

Corporate sustainability goals | To drive strategic initiatives to manage Tecan’s environmental, | 20% |

Total |

| 100% |

LONG-TERM EQUITY INCENTIVE AWARD – PERFORMANCE SHARE MAtCHING PLAN (PSMP)

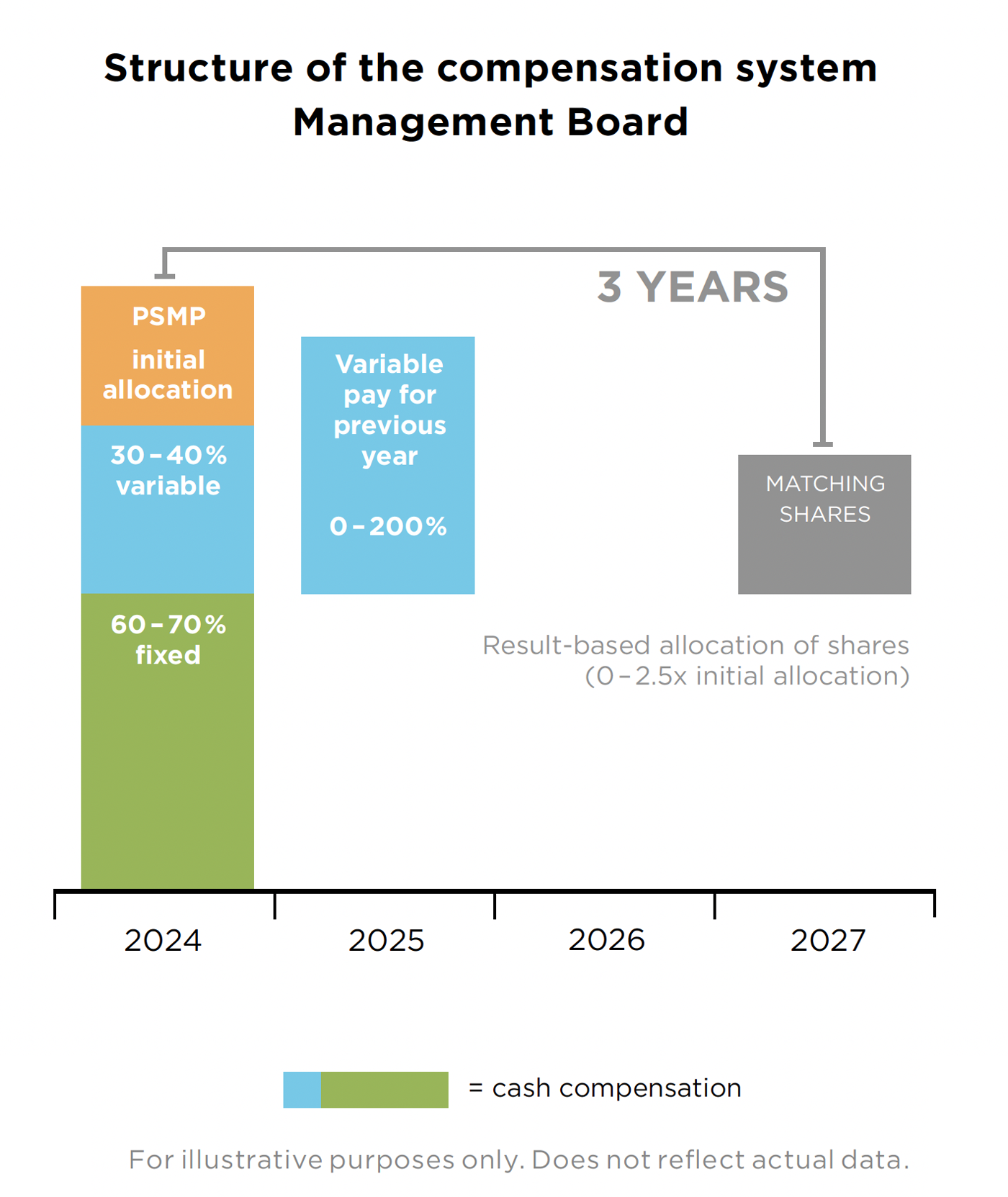

In addition to the cash compensation, the members of the Management Board participate in a long-term equity incentive award, the Performance Share Matching Plan (also referred to as executive restricted stock). The PSMP consists of an initial grant of registered shares and a potential subsequent allocation of matching shares based on the achievement of performance objectives during a three-year plan period.

The target amount of the initial grant is expressed as a fixed monetary amount, which is converted into shares based on the Tecan share’s average closing price on the SIX Swiss Exchange during the first four months of the relevant financial year. The shares allocated are blocked for three years – starting in the grant year as “year one”. For each granted share, members of the Management Board are eligible to receive additional shares (“matching shares”) at the end of the three-year measurement cycle if certain performance objectives are reached. This mechanism ensures that the interests of the Management Board are aligned with those of the shareholders, and it also ensures a permanent minimum level of share ownership of the CEO and of each member of the Management Board that is equivalent to the initial grants of three years.

An alternative share-blocking period of five years was discussed with stakeholders and considered in 2023. As peer benchmarking has shown that Tecan’s Management Board compensation is already structured towards longer term rather than short-term reward relative to peers, increasing this emphasis further with a longer share-blocking period of five years was assessed as being on balance not supportive of Tecan’s talent attraction and retention ambitions. To avoid this effect, a five-year blocking period would have to be offset with higher short-term rewards, and the overall result would be less aligned with the interests of Tecan’s shareholders.

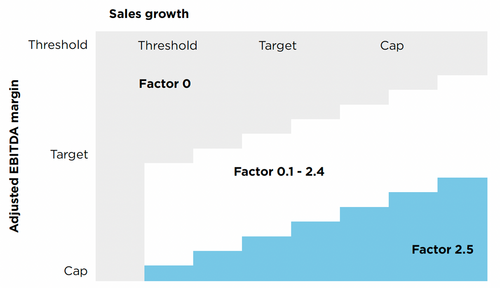

Depending on the performance achievement during the three-year period, members of the Management Board may receive from 0 up to 2.5 matching shares for each share granted in year one. The performance is assessed using a payout matrix based on two performance criteria: sales growth in local currencies and adjusted EBITDA margin. The matrix combines the performance of each of the criteria to calculate the payout, thus providing for a balanced focus on both top-line and bottom-line achievements. Every year, Tecan’s Board of Directors reviews and approves a rolling five-year mid-term business plan presented by the Management Board, including targets for sales growth in local currencies and adjusted EBITDA margin. In the event that the midterm targets are achieved for the three years covering a specific PSMP, an additional 1.25 matching shares for each initial share will be allocated to members of the Management Board. A payout factor of 2.5 would require an achievement significantly above the defined mid-term targets on the two performance criteria. An achievement level below a certain threshold on any of the criteria results in no additional matching shares. Different combinations of sales growth and adjusted EBITDA margin achievements within those ranges lead to payouts between a factor of 0 and a factor of 2.5.

The parameter grid is specified each year on a forward-looking basis for the coming three-year period (i.e., financial objectives are pre-determined upfront). Prospective disclosure of actual examples of implementation of Tecan’s Performance Share Matching Plan for the three-year cycle 2024 – 2026 is shown via the chart and table further below. These show that the design of the PSMP is effective: in line with Tecan’s ambitious target-setting, substantial progress needs to be made to reach the maximum payout factor of 2.5 upon expiry of the performance cycle.

In case of voluntary resignation (other than for retirement), the entitlement to any matching shares is forfeit. The initial shares granted are subject to a regular blocking period. In case of death, invalidity or change of control, the initially granted shares deblock immediately with an allocation of matching shares as soon as possible after such occurrence. In case of a termination for cause of the employment contract by the employer, any entitlement to matching shares is forfeited and any initial grants of each running cycle have to be returned by the employee. The immediate unblocking of shares in the event of a change of control was a topic reviewed with stakeholders in 2023, in particular the concern that this clause in the PSMP could hinder a change of control. The total value of shares in scope of this consideration has a strong influence on whether such an unblocking provision could hinder or rather facilitate a change of control. In Tecan’s case, the value of shares in scope relative to the total value of the company and importance of Management Board facilitation for a beneficial change of control opportunity leads the Board of Directors to the conclusion that the clause regarding the immediate unblocking of shares should continue to stay in effect for the Performance Share Matching Plan.

ILLUSTRATION [5]: PROSPECTIVE PERFORMANCE MEASURES FOR THE PERFORMANCE MATCHING SHARES (EXAMPLES) FOR THREE-YEAR CYCLE 2024-2026

Performance measures |

| Sales growth | Adjusted EBITDA |

Driver/rationale |

| To drive top-line growth | To drive the bottom-line profitability |

Weighting |

| Two-thirds | One-third |

Payout matrix |

|

| |

TABLE [2]: PROSPECTIVE PERFORMANCE MEASURES FOR THE PERFORMANCE MATCHING SHARES (EXAMPLES) FOR THREE-YEAR CYCLE 2024-2026

Payout matrix (actual examples of sales growth and EBITDA margin combination for a payout factor of 0.5) |

| Sales growth (CAGR) in local currency | Adjusted EBITDA margin |

4.0% | 20.5% | ||

10.0% | 18.0% | ||

14.0% | 16.75% | ||

Payout matrix (actual examples of sales growth and EBITDA margin combination for a payout factor of 1.2) |

| Sales growth (CAGR) in local currency | Adjusted EBITDA margin |

4.0% | 21.25% | ||

6.0% | 20.0% | ||

12.0% | 18.25% | ||

Payout matrix (actual examples of sales growth and EBITDA margin combination for a payout factor of 2.5) |

| Sales growth (CAGR) in local currency | Adjusted EBITDA margin |

4.5% | 22.75% | ||

8.0% | 21.25% | ||

14.0% | 19.0% |

EMPLOYMENT CONTRACTS

Members of the Management Board are employed under employment contracts of unlimited duration. The employment contract of the CEO is subject to a notice period of 12 months, while all other employment contracts of members of the Management Board are subject to a notice period of 6 months. Management Board members are not contractually entitled to any severance payments or any change of control provisions other than those under the PSMP termination provisions. Their contracts do not contain non-competition provisions.

EXTERNAL MANDATES

External mandates as required by the Swiss Code of Obligations pursuant to Art. 734e are shown below table [3].

TABLE [3]: MEMBERS WITH EXTERNAL MANDATES, AS PER DECEMBER 31, 2024 (AUDITED)

|

| Mandates in listed companies | Mandates in non-listed companies |

Board of Directors |

|

|

|

Dr. Lukas Braunschweiler |

| Sonova Holding AG (Stäfa, CH), | none |

Dr. Christa Kreuzburg |

| none | none |

Matthias Gillner |

| none | Hilti Group AG (Schaan, FL), |

Myra Eskes |

| none | none |

| Dr. Oliver Fetzer | none | none | |

Dr. Karen Huebscher |

| Sandoz Group (Basel, CH), | BBI Group (Crumlin, UK), Member of the Board of Directors1 Ivoclar (Schaan, FL), Member of the Board of Directors |

Monica Manotas |

| none | none |

Dr. Daniel R. Marshak |

| none | RareCyte, Inc. (Seattle, USA), |

Management Board |

|

|

|

Dr. Achim von Leoprechting |

| none | none |

Tania Micki |

| ASM International (Almere, NL), Member of the Board of Directors | EHL Holding SA (Lausanne, CH), |

Mukta Acharya |

| none | none |

Ralf Griebel |

| none | none |

Ulrich Kanter |

| none | Toolpoint for Lab Science (Egg, CH), Member of the Board of Directors1 |

Erik Norström |

| none | Labforward GmbH (Berlin, Germany), |

Ingrid Pürgstaller |

| none | none |

Andreas Wilhelm |

| none | none |

Dr. Wael Yared |

| none | none |

- External mandate already existed in previous reporting period.

COMPENSATION TO THE BOARD OF DIRECTORS (AUDITED)

TABLE [4]: ANNUAL COMPENSATION OF THE BOARD OF DIRECTORS IN 2024 and 2023

CHF 1,000 | Year | Fixed fee | Committee fee | Total cash compensation | Social benefits1 | Share award plan: shares granted (number)2 | Fair value of shares granted3 | Total |

Dr. Lukas Braunschweiler | 2024 | 200 | – | 200 | 17 | 253 | 82 | 299 |

2023 | 200 | 3 | 203 | 18 | 256 | 98 | 319 | |

Myra Eskes | 2024 | 80 | 20 | 100 | 11 | 114 | 37 | 148 |

2023 | 80 | 22 | 102 | 11 | 115 | 44 | 157 | |

Dr. Oliver S. Fetzer | 2024 | 80 | 23 | 103 | – | 114 | 37 | 140 |

2023 | 80 | 33 | 113 | – | 115 | 44 | 157 | |

Matthias Gillner | 2024 | 80 | 30 | 110 | 11 | 114 | 37 | 158 |

2023 | 53 | 5 | 58 | 4 | – | – | 62 | |

Dr. Karen Huebscher | 2024 | 80 | 27 | 107 | 11 | 114 | 37 | 155 |

2023 | 80 | 42 | 122 | 13 | 115 | 44 | 179 | |

Dr. Christa Kreuzburg | 2024 | 80 | 40 | 120 | 9 | 114 | 37 | 166 |

2023 | 80 | 42 | 122 | 13 | 115 | 44 | 179 | |

Monica Manotas | 2024 | 53 | 13 | 66 | – | – | – | 66 |

2023 | – | – | – | – | – | – | – | |

Dr. Daniel R. Marshak | 2024 | 80 | 20 | 100 | - | 114 | 37 | 137 |

2023 | 80 | 23 | 103 | - | 115 | 44 | 147 | |

|

|

|

|

|

|

|

|

|

Total | 2024 | 733 | 173 | 906 | 59 | 937 | 304 | 1,269 |

| 2023 | 683 | 177 | 860 | 62 | 972 | 372 | 1,294 |

- Employer’s contribution to social security

- Vesting condition: Graded vesting from May 1, 2023 to April 30, 2025 (Share Plan BoD 2023) and from May 1, 2024 to April 30, 2025 (Share Plan BoD 2024). Vested shares are transferred at the end of the service period (April 30, 2024 and April 30, 2025, respectively). The shares are fully included in the amount of fair value of shares granted

- Formula for 2023: Shares granted in 2023 * fair value at grant (CHF 383.60) and formula for 2024: Shares granted in 2024 * fair value at grant (CHF 325.60)

At the 2023 Annual General Meeting, shareholders approved a maximum aggregate compensation amount of CHF 1,450,000 for the Board of Directors for the compensation period from the 2023 Annual General Meeting until the 2024 Annual General Meeting. The actual compensation paid to the Board of Directors for 2024 was CHF 1,269,000.

At the 2024 Annual General Meeting, shareholders approved a maximum aggregate compensation amount of CHF 1,700,000 for the Board of Directors for the term from the 2024 Annual General Meeting until the 2025 Annual General Meeting. This compensation period is not completed yet and a conclusive assessment will be provided in the 2025 Compensation Report.

COMPENSATION TO THE MANAGEMENT BOARD (AUDITED)

COMPENSATION AT GRANT VALUE

The table [5] shows the compensation of the CEO and the other members of the Management Board granted in the reporting year.

TABLE [5]: GRANTED COMPENSATION

|

|

|

|

|

|

|

|

|

| Number of granted / awarded shares | ||

CHF 1,000 (gross amounts) | Year | Fixed Base Salary | Taxable fringe benefits | Social | Short-term variable compen-sation2 | Fair value of PSMP initial shares (in the year of grant)3 | Fair value of PSMP matching shares (in the year of grant)4 | Total compen-sation (granted) |

| PSMP: number of shares initial grant | PSMP: number of matching shares (at factor 1.25) | PSMP: number of matching shares (at maximum) |

Dr. Achim von Leoprechting5 (CEO) | 2024 | 675 | 11 | 296 | 136 | 850 | 1,063 | 3,031 |

| 2,611 | 3,264 | 6,528 |

2023 | 671 | 15 | 342 | 380 | 774 | 967 | 3,149 |

| 2,017 | 2,521 | 5,043 | |

Tania Micki6 (CFO) | 2024 | 398 | 12 | 174 | 52 | 416 | 520 | 1,572 |

| 1,277 | 1,596 | 3,193 |

2023 | 396 | 11 | 197 | 144 | 387 | 484 | 1,619 |

| 1,009 | 1,261 | 2,523 | |

Other members of the Management Board7 | 2024 | 2,264 | 325 | 1,042 | 291 | 2,034 | 2,543 | 8,498 |

| 6,299 | 7,874 | 15,748 |

2023 | 2,166 | 64 | 1,168 | 790 | 2,008 | 2,511 | 8,696 |

| 5,234 | 6,543 | 13,087 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total | 2024 | 3,337 | 348 | 1,512 | 479 | 3,300 | 4,126 | 13,101 |

| 10,187 | 12,734 | 25,468 |

2023 | 3,233 | 90 | 1,707 | 1,314 | 3,169 | 3,962 | 13,475 |

| 8,260 | 10,325 | 20,653 | |

1 Employer's contribution to social security and contributions to post-employment benefit plans (including social security on shares transferred during the reporting period).

2 Payment will be made in the following year

3 Formula for 2023: Shares granted in 2023 * fair value at grant (CHF 383.60)

3 Formula for 2024: Shares granted in 2024 * fair value at grant (CHF 325.60). Exception: fair value at grant for Mukta Acharya, who started effective August 15, 2024, was CHF 280.20

4 Formula for 2023: Shares granted in 2023 * fair value at grant (CHF 383.60) * 1.25. The disclosed amount corresponds to the fair value of the matching shares at the time of grant (e.g. based on performance achievement at target). This value may differ from the value of the accruals disclosed under IFRS reporting, as those are based on a best-estimate at the end of the reporting year

4 Formula for 2024: Shares granted in 2024 * fair value at grant (CHF 325.60) * 1.25. The disclosed amount corresponds to the fair value of the matching shares at the time of grant (e.g. based on performance achievement at target). This value may differ from the value of the accruals disclosed under IFRS reporting, as those are based on a best-estimate at the end of the reporting year. Exception: fair value at grant for Mukta Acharya, who started effective August 15, 2024, was CHF 280.20.

5 Member of the Management Board with the highest compensation in 2023 and 2024

6 Member of the Management Board with the second highest compensation in 2023 and 2024

7 2023: Total seven members. 2024: Total eight members. Figures for Other Members of the Management Board includes an overlap of 2.5 months for the position of Executive Vice President, Life Science Business. Klaus Lun left Tecan effective 31.10.2024. His successor, Mukta Acharya, took over the position effective August 15, 2024.

Explanatory comments on the compensation table:

Details for the achievement of targets for short-term variable cash compensation in 2024 are given below.

At the 2023 Annual General Meeting, shareholders approved a maximum aggregate compensation amount of CHF 20,500,000 for the Management Board for the financial year 2024. The actual compensation awarded to the Management Board in 2024 was CHF 13,101,000 and is therefore within the approved limits.

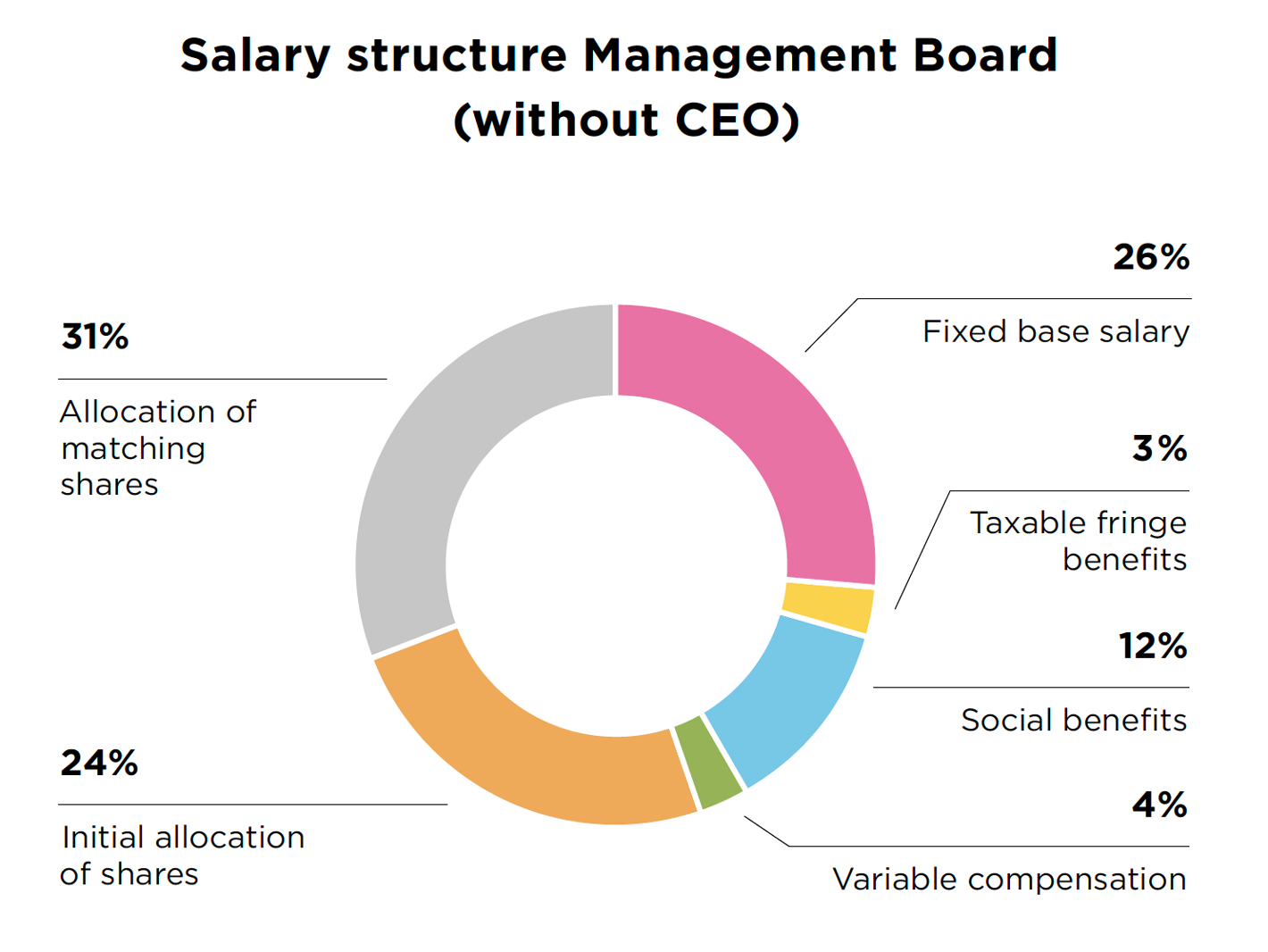

ILLUSTRATION [6]: COMPENSATION MIX

PERFORMANCE IN 2024

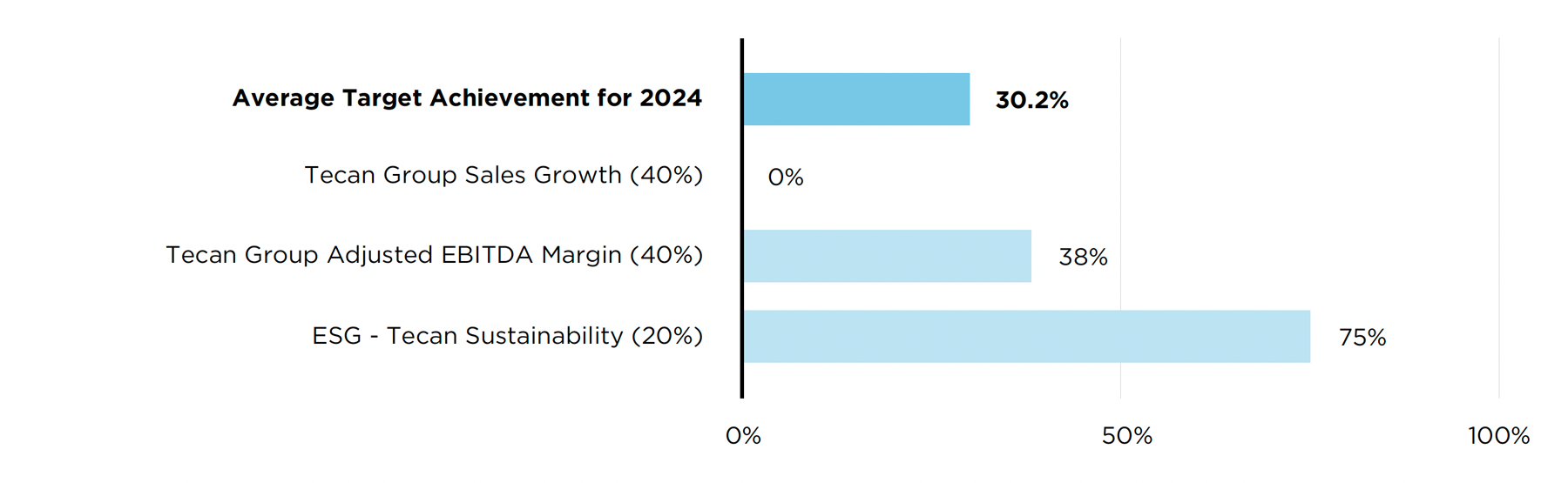

Reported sales for the Group for fiscal year 2024 decreased in comparison to fiscal year 2023 by 11.5% in local currencies, leading to a payout ratio of 0% for this component of the short-term variable cash compensation.

The adjusted EBITDA target resulted in a payout ratio of 38% for this component.

The sustainability objectives for cultural development, environment and governance achieved a ratio of 75% combined for these targets.

The financial performance indicators were equally weighted and accounted for 80% of the short-term variable cash compensation and the sustainability targets accounted for the remaining 20%. A detailed overview of the individual achievements relative to their set target is shown in illustration [7] below.

In the year under review, the 2022 to 2024 PSMP cycle came to an end. In the 2022 Annual Report the performance objectives for the three-year cycle 2022-2024 were disclosed prospectively, just as the current cycle is set out in table [2] above.

The actual performance achievement over the performance period resulted in a matching share factor of 0. This reflects for the cycle 2022 to 2024 an average growth rate of 0.4% and an average adjusted EBITDA margin of 19.8%.

ILLUSTRATION [7]: 2024 SHORT-TERM INCENTIVE TARGET ACHIEVEMENT

COMPENSATION TO FORMER MEMBERS OF GOVERNING BODIES

No compensation was paid to former members of the Board of Directors or the Management Board in 2024 after the end of their term of office or contract with Tecan, respectively.

COMPENSATION TO RELATED PARTIES

No compensation was paid in 2024 or the previous year to parties related to present or former members of the Board of Directors or the Management Board.

LOANS AND CREDITS

CURRENT AND FORMER MEMBERS OF GOVERNING BODIES

Neither in 2024 nor in the previous year were any loans or credits extended to current or former members of the Board of Directors or the Management Board that remained outstanding at the end of the year.

RELATED PARTIES

Neither in 2024 nor in the previous year were any loans or credits extended to related parties of current or former members of the Board of Directors or the Management Board that remained outstanding at the end of the year.

SHAREHOLDINGS OF THE MEMBERS OF THE BOARD OF DIRECTORS AND THE MANAGEMENT BOARD IN 2024 (AUDITED)

SHARE AND OPTION OWNERSHIP OF THE BOARD OF DIRECTORS AND MANAGEMENT BOARD

For details of the employee participation plans please refer to note 12.4 of the consolidated financial statements.

TABLE [6]: SHARE AND OPTION OWNERSHIP OF THE BOARD OF DIRECTORS

| Year | Total options | Total shares |

Number |

|

|

|

Dr. Lukas Braunschweiler (Chairman) | 2023 | – | 1,790 |

2024 | – | 2,043 | |

Myra Eskes | 2023 | – | 115 |

2024 | – | 229 | |

Dr. Oliver S. Fetzer | 2023 | – | 3,256 |

2024 | – | 3,370 | |

Matthias Gillner | 2023 | – | 70 |

2024 | – | 184 | |

Dr. Karen Huebscher | 2023 | – | 983 |

2024 | – | 1,097 | |

Dr. Christa Kreuzburg | 2023 | – | 115 |

2024 | – | – | |

Monica Manotas1 (since April 2024) | 2023 | – | – |

2024 | – | – | |

Dr. Daniel R. Marshak | 2023 | – | 758 |

2024 | – | 872 | |

|

|

|

|

Balance at December 31, 2023 |

| – | 7,087 |

Balance at December 31, 2024 |

| – | 7,795 |

- Shares and share options in 2023 are not disclosed because the member of the Board joined after year-end 2023.

TABLE [7]: SHARE AND OPTION AND OWNERSHIP OF THE MANAGEMENT BOARD

| Year | Total options | Total shares |

Number |

|

|

|

Dr. Achim von Leoprechting (CEO) | 2023 | – | 4,998 |

2024 | – | 6,329 | |

Tania Micki (CFO) | 2023 | – | 2,838 |

2024 | – | 3,309 | |

Mukta Acharya1 | 2023 | – | – |

2024 | 901 | 708 | |

Ralf Griebel | 2023 | – | 2,312 |

2024 | – | 2,515 | |

Ulrich Kanter | 2023 | – | 2,310 |

2024 | – | 2,475 | |

Dr. Klaus Lun2 | 2023 | – | 2,458 |

2024 | – | – | |

Erik Norström | 2023 | – | 2,049 |

2024 | – | 2,156 | |

Ingrid Pürgstaller | 2023 | – | 1,839 |

2024 | – | 2,097 | |

Andreas Wilhelm | 2023 | – | 2,012 |

2024 | – | 2,156 | |

Dr. Wael Yared | 2023 | – | 4,361 |

2024 | – | 4,010 | |

|

|

|

|

Balance at December 31, 2023 |

| – | 25,177 |

Balance at December 31, 2024 |

| 901 | 25,755 |

- Shares and share options in 2023 are not disclosed because the member of the Board joined after year-end 2023.

- Shares and share options in 2024 are not disclosed because the member of the Board stepped down before year-end 2024.

OUTLOOK AND MOTIONS ON COMPENSATION AT THE ANNUAL GENERAL MEETING

At the 2025 Annual General Meeting, the Board of Directors will propose:

- the maximum aggregate compensation amount for the Board of Directors, for the next term of office (binding vote)

- the maximum aggregate compensation amount for the Management Board, for the financial year 2026 (binding vote)

- the 2024 Compensation Report (retrospective advisory vote)

MAXIMUM AGGREGATE COMPENSATION AMOUNT FOR THE BOARD OF DIRECTORS

The maximum aggregate compensation amount for the Board of Directors for the term of office between the 2025 and the 2026 Annual General Meeting submitted to vote is based on the following elements:

- the number of members on the Board of Directors stays the same

- fixed basic fee paid in cash and restricted share units

- committee fees paid in cash

- additional committee fees for ad-hoc committees and a travel fee (for members of the Board of Directors located overseas only)

MAXIMUM AGGREGATE COMPENSATION AMOUNT FOR THE MANAGEMENT BOARD

The maximum aggregate compensation amount to the Management Board for the financial year 2026 submitted to vote is based on the following elements:

- nine members of the Management Board

- short-term variable cash compensation: the maximum amount assumes that the defined performance objectives are significantly exceeded and that the short-term variable cash compensation payout amounts to 200% (maximum)

- long-term equity incentive award (PSMP): the maximum amount is based on a matching share factor of 2.5 (maximum). A possible share price appreciation during the three-year vesting period is not considered

Table [8] below shows a comparison between the maximum aggregate compensation amounts approved and the compensation effectively awarded in recent years.

TABLE [8]: COMPENSATION APPROVED VERSUS AWARDED (MANAGEMENT BOARD)

In CHF per year (gross) | Fiscal year 20261 | Fiscal year 2025 | Fiscal year 2024 | Fiscal year 2023 |

Approved compensation amount | n.a. | 20,500,000 | 20,500,000 | 20,500,000 |

Compensation awarded | n.a. | n.a.2 | 13,101,000 | 13,473,763 |

- to be proposed to the 2025 Annual General Meeting

- compensation period not yet completed

Note:The approved compensation amount is based on the assumption that all performance indicators under both the short-term variable cash compensation and the PSMP will be significantly overachieved and that the payout factor will be at the maximum possible level. The approved compensation amount does not account for any share price appreciation over the three-year period of the PSMP. The awarded compensation amount is based on the short-term variable cash compensation effectively paid and on the fair value of the initial shares and of the matching shares granted under the PSMP in the respective year.