Performance of the Tecan share in 2023

After accelerating inflation and rising interest rates sent stocks into a bear market in 2022, the stock market recovered again in 2023. The year's positive share price performance was primarily driven by price gains at the end of the year, with Fed Chairman Jerome Powell signaling that the cycle of interest rate hikes was over and that interest rate cuts were on the cards for 2024.

Overall, the financial year 2023 generated mostly positive headlines. The MSCI World Index in CHF achieved a performance of 10.8% over the year as a whole. This strong performance was primarily due to the "Magnificent Seven" technology stocks in the US, which recorded substantial price gains thanks to the promising prospects for the use of artificial intelligence.

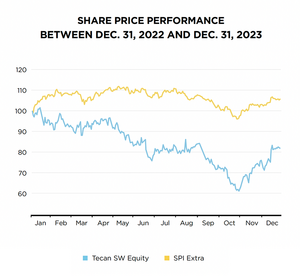

The Swiss equity market was unable to keep pace due to its defensive weighting and the strength of the Swiss franc. The SMI, which covers Swiss blue-chip stocks, was up by 3.8% for the year. The SPI Extra, which comprises the small and mid-cap companies listed on the SIX Swiss Exchange, outperformed the large-cap stocks and closed at +6.5%.

The Life Science Tools sector, which Tecan is considered part of, has underperformed the broader market for the second year in a row. Healthcare stocks were generally under-owned as was the Life Science Tools sector specifically within healthcare following robust COVID over-performance in 2020 and 2021. The underperformance of the sector in 2023 was driven by a myriad of headwinds including: the elongation of bioprocessing destocking timelines, a difficult funding environment for biotech companies, tighter pharma budgets and a deteriorating macro environment in China that reverberated across the entire sector.

At CHF 343.40, shares of Tecan finished the year at -16.7% and a market capitalization of CHF 4.4 billion at the end of the year.

Share information

Listing: | SIX Swiss Exchange |

Stock name: | Tecan Group |

Security number: | 1210019 |

ISIN: | CH0012100191 |

Bloomberg: | TECN SW |

Reuters: | TECN.S |

TECAN SHARE

| 2021 | 2022 | 2023 |

Numbers of shares issued | 12,678,108 | 12,731,441 | 12,783,087 |

Number of shares outstanding at December 31 | 12,678,108 | 12,731,441 | 12,783,087 |

Average number of shares outstanding | 12,225,180 | 12,716,274 | 12,770,050 |

Share price at December 31 (CHF) | 555.50 | 412.40 | 343.40 |

High (CHF) | 594.50 | 515.00 | 428.00 |

Low (CHF) | 362.00 | 268.20 | 256.40 |

Average number of traded shares per day1 | 27,745 | 30,874 | 32,253 |

Average trading volume per day (CHF)1 | 13,412,765 | 14,925,418 | 15,592,068 |

Information per share

| 2021 | 2022 | 2023 |

Basic earnings per share (CHF/share) | 9.95 | 9.53 | 10.34 |

Adjusted earnings per share (CHF/share) | 12.35 | 12.14 | 12.88 |

Shareholders’ equity at December 31 (CHF 1,000) | 1,224,895 | 1,357,720 | 1,348,910 |

Dividend (CHF) | 2.80 | 2.90 | 3.002 |

Dividend yield (%)3 | 0.54% | 0.70% | 0.87% |

Financial ratios

| 2021 | 2022 | 2023 |

Market capitalization (CHF million)4 | 7,042.7 | 5,250.4 | 4,389.7 |

Price Earnings Ratio5 | 44.98 | 33.97 | 26.66 |

- Including off-exchange trading

- Proposal to the Annual General Meeting of Shareholders on April 18, 2024

- At share price as of Dec 31

- Number of shares issued multiplied with share price as of Dec 31

- Share price as of Dec 31 divided by adjusted earnings per share

Follow Tecan